This article is part of the special bulletin “Tree plantations for the carbon market: more injustice for communities and their territories”.

See here the complete bulletin.

Climate chaos requires that companies stop extracting and using petroleum and other fossil fuels. This would, of course, shake the foundations of a global economy built on cheap energy generated by burning fossil coal, gas and oil, while also threatening the profits of some of the planet’s wealthiest corporations.

To delay the inevitable and discourage governments from passing laws that require companies to actually reduce their emissions in line with what is needed to avoid uncontrollable climate chaos, corporations, together with the US and other governments, have devised the mechanism of carbon offsetting.

The trade in carbon offsets has grown rapidly following the signing of the Paris Agreement in 2016, and it has seen scandals and widespread criticism. With a turnover of US$ 2.4 billion in 2023,(1) the voluntary carbon market has turned into a promising profit opportunity for companies taking part in it. On the one hand, giant corporations producing emissions from fossil fuel-based activities can continue and even expand their businesses, claiming their emissions are being offset. They benefit from the claim that buying carbon offsets makes them "carbon-neutral," suggesting that they are doing their part to tackle climate change.(2)

However, polluters who buy carbon offsets are not the only ones profiting from this new business opportunity. Many other ‘players’ – such as carbon firms, traders, auditors, rating agencies, certification consultancies, and investment funds – have discovered that there is quick money to be made from generating and marketing carbon credits.

The more this market grows, the more it diverts and delays industrial countries – most responsible for the climate chaos – from attacking the root causes of the problem and taking measures such as leaving fossil fuels in the ground.

Carbon offsetting and trees in a nutshell

The logic of offsetting emissions through projects that prevent deforestation or by planting trees is based on the fact that trees absorb carbon from the atmosphere and store it in their leaves, trunks and roots. As such, anyone who plants extra trees and claims they would not have been planted without the expected income from the carbon market can earn money by selling carbon credits to companies that claim they are unable to reduce their own emissions. The extra carbon allegedly stored by planting extra trees cancels out – or ‘offsets’ – the extra fossil carbon. On a balance-sheet, the result of the calculation is (net) zero. This is why many polluting companies have published ‘net-zero’ emission promises rather than ‘zero emission’ promises: adding the ‘net’ allows them to continue polluting as long as they purchase enough carbon credits.

Why are corporations so interested in carbon offsetting?

Mineral coal, fossil oil and gas are made up of ancient biomass that lived millions of years ago. The carbon stored in this fossil biomass is released into the atmosphere when these fossil fuels are burned. Because so much fossil carbon has been added to the atmosphere, the climate is rapidly changing. The solution is to stop putting fossil carbon into the atmosphere by turning off the fossil fuel tap. However, many corporations would see their profits drop sharply if they stopped burning fossil fuels. It is therefore very convenient for them to claim that other initiatives (such as planting trees) can remove carbon from the atmosphere, making room for their additional carbon discharges. The corporations argue they do not cause damage to the climate even if they keep pumping fossil carbon into the atmosphere.

The misguided concept of offsetting emissions by planting or conserving trees has many contradictions. The most basic of these is the fact that its logic completely ignores the fundamental differences between “fossil carbon” and “biotic carbon,” which are also called slow and fast carbon cycles (see more about the differences in Is All Carbon the Same?). In addition, the certification of carbon offsetting projects – in particular avoided deforestation and tree planting projects – is also contradictory and intrinsically incapable of doing what it set out to do.

As a result, tree-based projects have generated millions of “phantom” credits – that is, credits not backed by any extra carbon stored in trees. Beyond the profusion of phantom credits, other recurrent impacts of these projects include land grabs and other forms of violence against communities that occur when such projects are implemented (click here to review a bank of evidence). Finally, the idea of carbon offsetting makes all the other impacts of fossil carbon extraction invisible.

Creating and trading carbon credits

Carbon credits are the tradeable units that make up carbon markets. In theory, a carbon credit represents the reduction or removal of one ton of carbon dioxide from the atmosphere. In other words, one carbon credit works like a voucher for its holder to emit one ton of carbon dioxide, hence the term ‘offsetting.’ Thus, when a company claims to be “net-zero” or “carbon-neutral,” it is usually because it has bought as many carbon credits as the carbon emissions that it continues to produce.

Rather than a physical product or commodity, a carbon credit resembles instruments traded in financial markets such as stocks, bonds and other securities. It explains why carbon credits are not only purchased by companies and individuals who want to offset their emissions, but also by traders and speculators. One carbon credit is currently worth somewhere between less than US$ 1 and many dozens of US dollars. In any case, once the emissions to be offset occur, the 'license to pollute' given by the carbon credit terminates, and the carbon credit is removed from the market – or 'retired,' to use carbon market jargon.

Carbon credits are generated by projects that claim to remove carbon dioxide from the atmosphere or to prevent new carbon emissions. For such a scheme to count as an offsetting project and participate in carbon markets, it must be certified as such. Typically, there are three different mechanisms under which these projects can be developed to generate and sell carbon credits:

• Mechanisms established by international treaties (such as the United Nations Clean Development Mechanism –CDM – and the Paris Agreement);

• Mechanisms developed by regional, national, or sub-national governments;

• Private mechanisms offered by entities such as Verra that create and manage independent (and highly unregulated) standards for carbon credit project certification. Over the last five years, this mechanism has accounted for most of the volume of carbon credits issued.(3)

Once generated, carbon credits are traded on two kinds markets:

- So-called “voluntary” markets in which companies buy credits for the purpose of complying with self-established mitigation commitments, avoiding regulation, obtaining finance for the expansion of their fossil fuel intensive production, and allowing them to advertise their products and services as ‘carbon neutral.’ Carbon credits traded in voluntary markets are mainly derived from private carbon standards.

- Compliance markets created by international, national or regional public policies that require companies to reduce or offset their emissions. One such example is the European Union Emissions Trading System (EU ETS). There is also a strong pressure to include carbon offsetting in the UN Paris Agreement. When people speak about “Article 6” of the Paris Agreement, they are referring to the controversial negotiations about the extent to which countries can use carbon offsets to achieve their emission reduction targets under the UN Paris Agreement.

Why are most carbon credits issued by land-based projects?

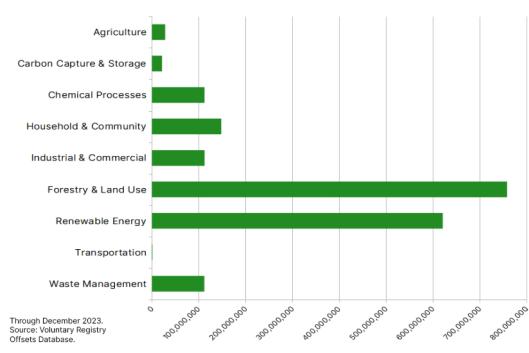

A wide range of activities can be used to apply for generating carbon credits. Examples include wind and solar energy projects, waste management, distributing ‘efficient’ cookstoves to communities, industrial carbon capture and enhanced industrial technologies, to mention just a few. However, the projects that lead the generation and sales of carbon credits are framed as so-called ‘Forestry & Land Use’ using carbon market jargon.

Quantity of carbon credits issued by scope

In the current carbon rush led by companies that want to be seen as carbon neutral, forest conservation and tree plantation projects have features that make them very attractive to investors. Compared to other categories, they generally require lower investments in relation to the number of credits they can generate. In addition, it is easier to manipulate the calculation of the volume of carbon credits that these land-based projects can generate. In doing so, project developers can exaggerate the carbon savings and thus increase the volumes of credits they can sell. (For more on this methodological issue, see What are the main types of tree plantation projects for carbon business, on this bulletin).

It is no coincidence that forest conservation projects that sell carbon credits have attracted the attention of dozens of investigators and researchers in recent years. These projects claim to reduce carbon emissions by avoiding deforestation. However, studies and articles have revealed fraud and chronic overstatement of the reduction in deforestation – that is, the stated goal of these projects, on which the calculation of their carbon credits is based.(4) As a direct consequence of these investigations, the demand for “nature-based”(5) credits fell sharply. The category of avoided deforestation projects, which held the largest share on the voluntary carbon market in 2022, became the least significant in 2023, according to the price reporting service Quantum Commodities Intelligence (QCI).(6)

Given that the main standard body for such forest conservation offset projects, Verra, was forced to put many projects "on hold", there was also a decrease on the supply side, with the issuance of credits from avoided deforestation projects shrinking abruptly by more than 40 percent in the same period. In response, carbon market profiteers launched a series of what they term ‘integrity’ initiatives. The promise of these initiatives is to deliver “high-quality” credits – and thus restore the reputational damage caused by the many cases of phantom credits. The inherent flaws of carbon offsetting, however, remain untouched by these initiatives.

These conservation projects claiming to avoid deforestation have been in the spotlight because it became clear that many are based on implausible stories about the threat of deforestation, overstating the emission reduction as a result of the project activities. With the climate crisis quickly accelerating, international climate discussions started to focus more on projects that could remove ‘excessive’ carbon from the atmosphere rather than just reduce the release of more carbon dioxide into the atmosphere. Therefore, ‘carbon removals’ (rather than the reduction of carbon dioxide emissions claimed by conservation or avoided deforestation projects) is quickly becoming the favoured type of carbon credit.

One project category profiting from this new interest in activities that remove carbon from the atmosphere is “afforestation and reforestation”, in which tree monocultures are included. Both the number and size of these tree plantation projects have grown significantly in recent years, attracting new types of investors and revealing new strategies used to profit from the lucrative trade in carbon offsets.

(1) Global Market Insights, 2023.

(2) Taking into account that this has become such a widespread practice of corporate greenwashing, and in view of the scandals that have come to light, the EU is banning products advertised as “environmentally friendly”, “climate neutral”, “eco” and other labels without evidence, while introducing a total ban on using carbon offsetting schemes to substantiate the claims. The Guardian, 2024. See here.

(3) The World Bank, 2022. State and Trends of Carbon Pricing 2022, p. 34.

(4) Examples include the reports by The Guardian, 2023; Follow the Money, 2023; and Rainforest Foundation UK, 2023, pp. 34 and 38.

(5) In carbon market jargon, ‘nature-based’ credits are those generated by avoided deforestation projects, afforestation, reforestation, regenerative agriculture, improved forest management, etc.

(6) Quantum Commodity Intelligence, 2024.